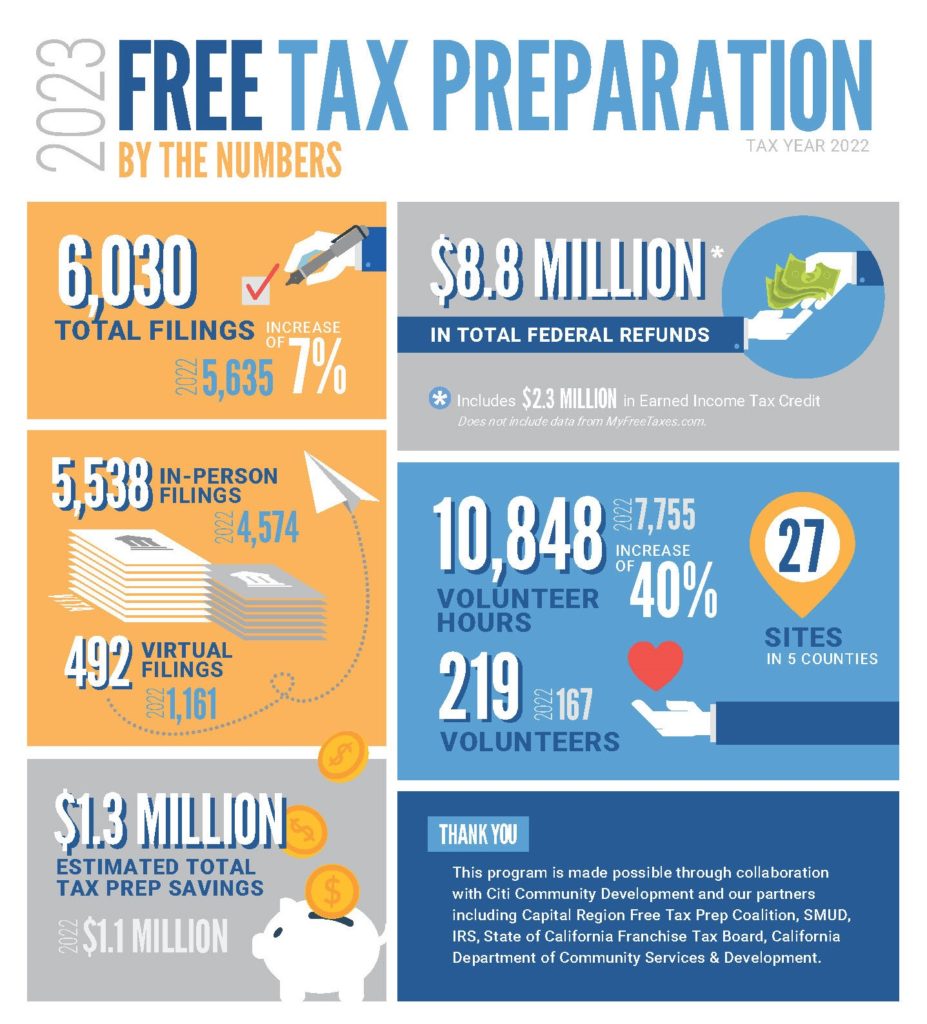

Helping thousands of families every year save more than $1 million in tax fees

The Free Tax Preparation program helps thousands of families receive close to $10 million in refunds – money that goes directly back into United Way’s five-county service region.

Who Is eligible

Households throughout the Capital Region earning less than $66,000 can receive free tax help from United Way’s Free Tax Prep program.